Strategies

Our Roadmap To Results

Our strategies are clear with solutions designed to deliver quality outcomes with confidence.

Market Indicators

Core Diversified ETF

Equity Baskets: High Beta Growth

Equity Baskets: Mega Cap Growth

Equity Baskets: Low Volatility Value

Equity Baskets: Dividend

Equity Baskets: Tax Efficient

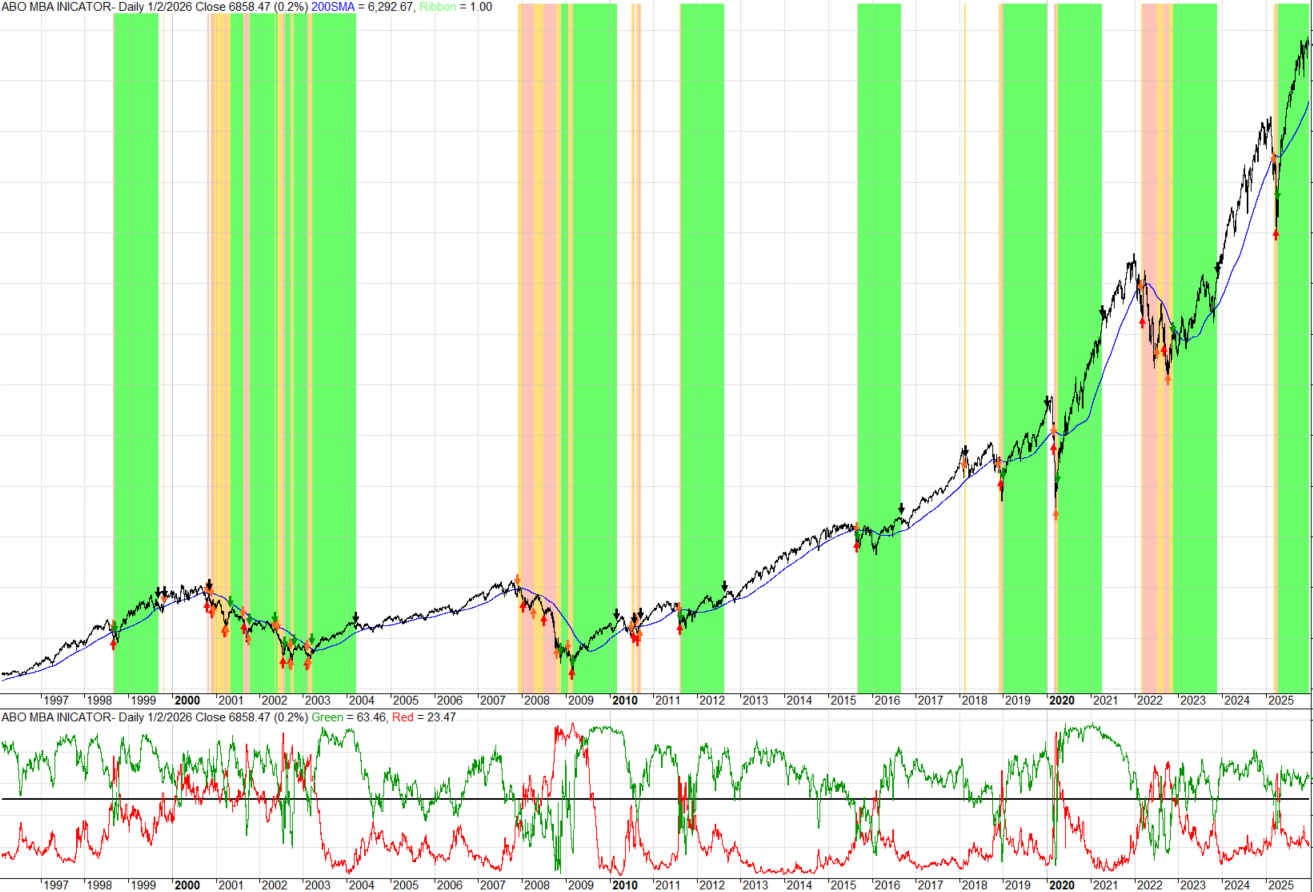

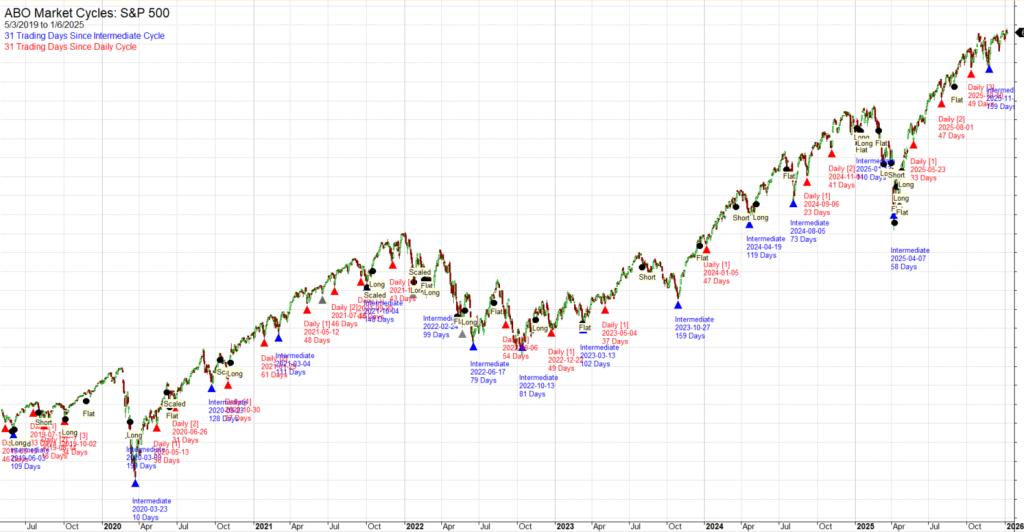

Market Indicators

Market indicators (e.g. cycles, trends, VIX targeting) monitor the markets for potential exit and entry signals. Our proprietary MBA Indicator aggressively seeks out market buying opportunities while also providing drawdown protection potential as a secondary objective. Our proprietary Cycles Indicator seeks downside protection by avoiding drawdowns with market participation over a full cycle.

Market indicators (e.g. cycles, trends, VIX targeting) monitor the markets for potential exit and entry signals. Our proprietary MBA Indicator aggressively seeks out market buying opportunities while also providing drawdown protection potential as a secondary objective. Our proprietary Cycles Indicator seeks downside protection by avoiding drawdowns with market participation over a full cycle.

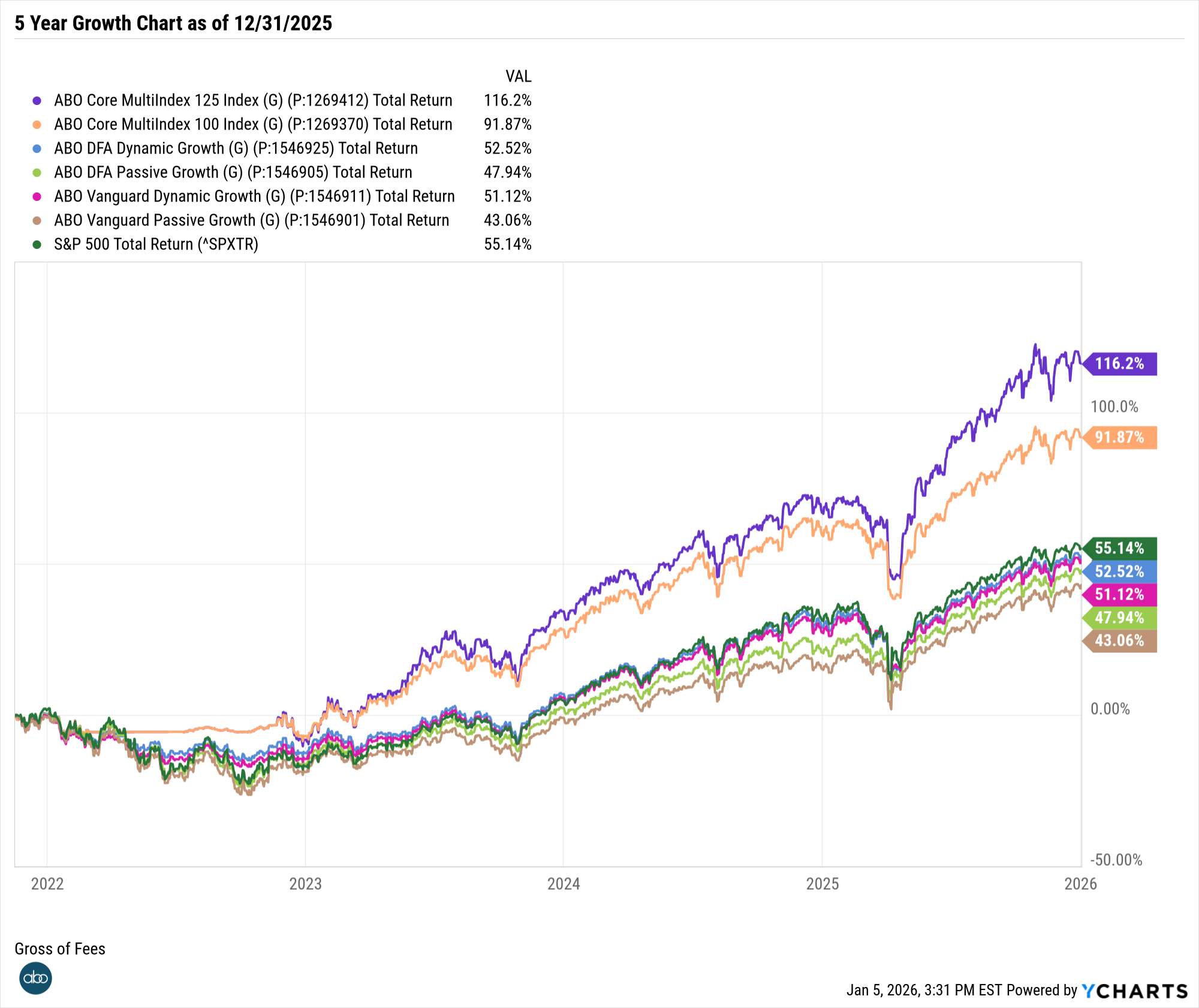

Core Multi-Index ETF

Core diversified strategies utilize low cost, broad-market ETFs/indexes to capture global returns at rock-bottom costs. The strategies hold 4 to 8 ETF positions. Our proprietary Multi-Index strategy is actively managed and incorporates technical analyses along with the risk on / risk off characteristics found in the ABO MBA Indicator. The Multi-Index 125 incorporates leverage while the Multi-Index 100 does not.

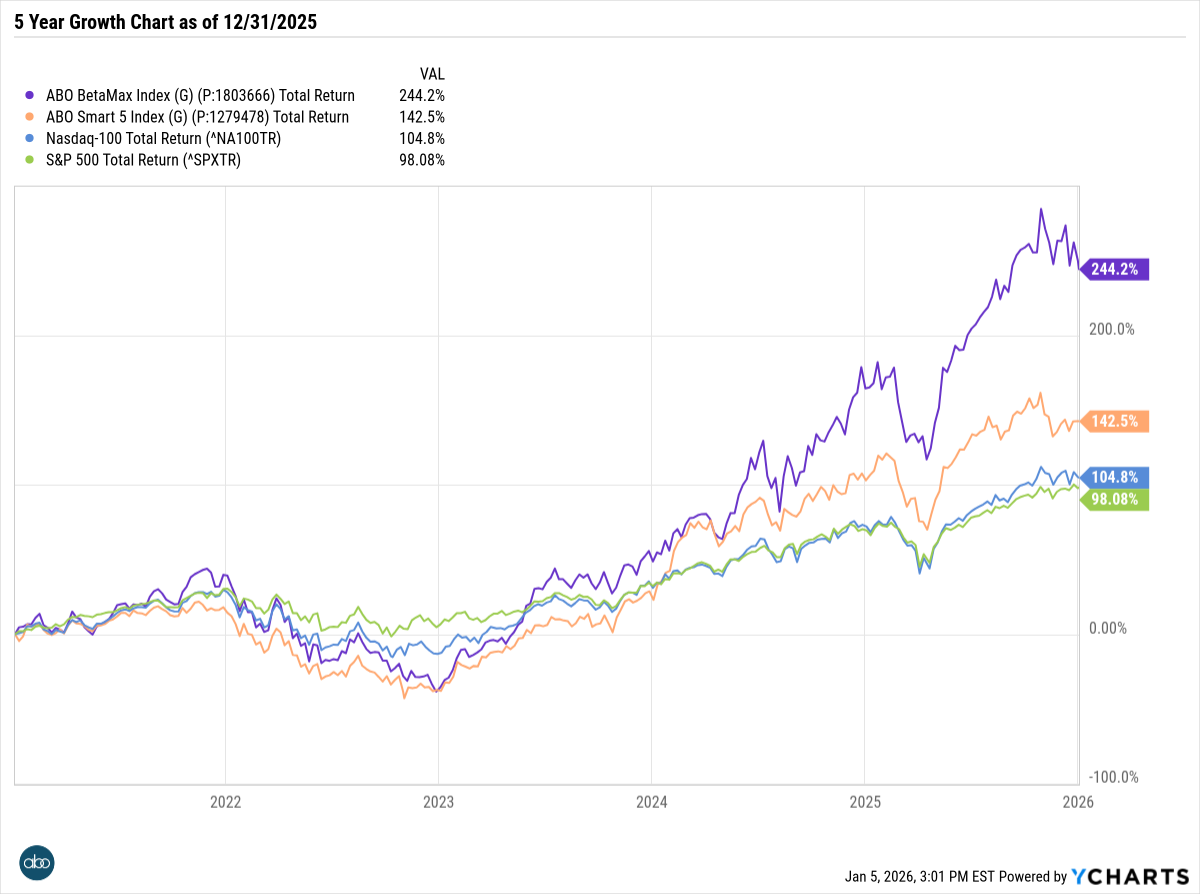

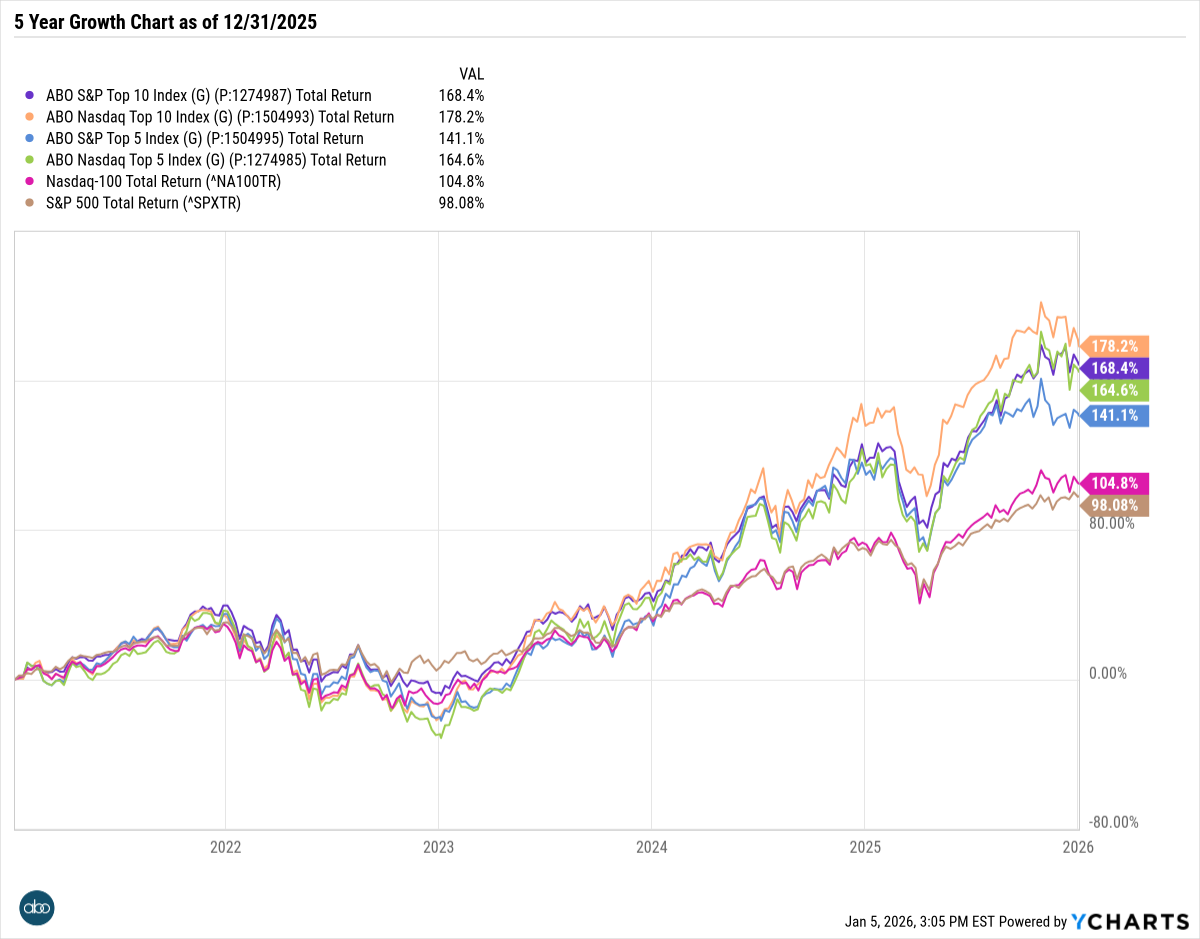

Equity Baskets: High Beta Growth

High-beta growth equity baskets are mechanical approaches that systematically target stocks with elevated sensitivity to market movements to amplify returns during bull markets, exploit momentum and leverage, and capitalize on risk-seeking investor behavior, accepting higher volatility and drawdowns in exchange for potential outperformance in rising environments. The baskets hold 5 to 10 stocks.

Equity Baskets: Mega Cap Growth

Mega-cap equity baskets are mechanical strategies that systematically select the largest companies by market capitalization to capture liquid, institutionally favored names dominated by passive flows into index funds to provide consistent benchmark alignment. The baskets hold 5 to 10 stocks.

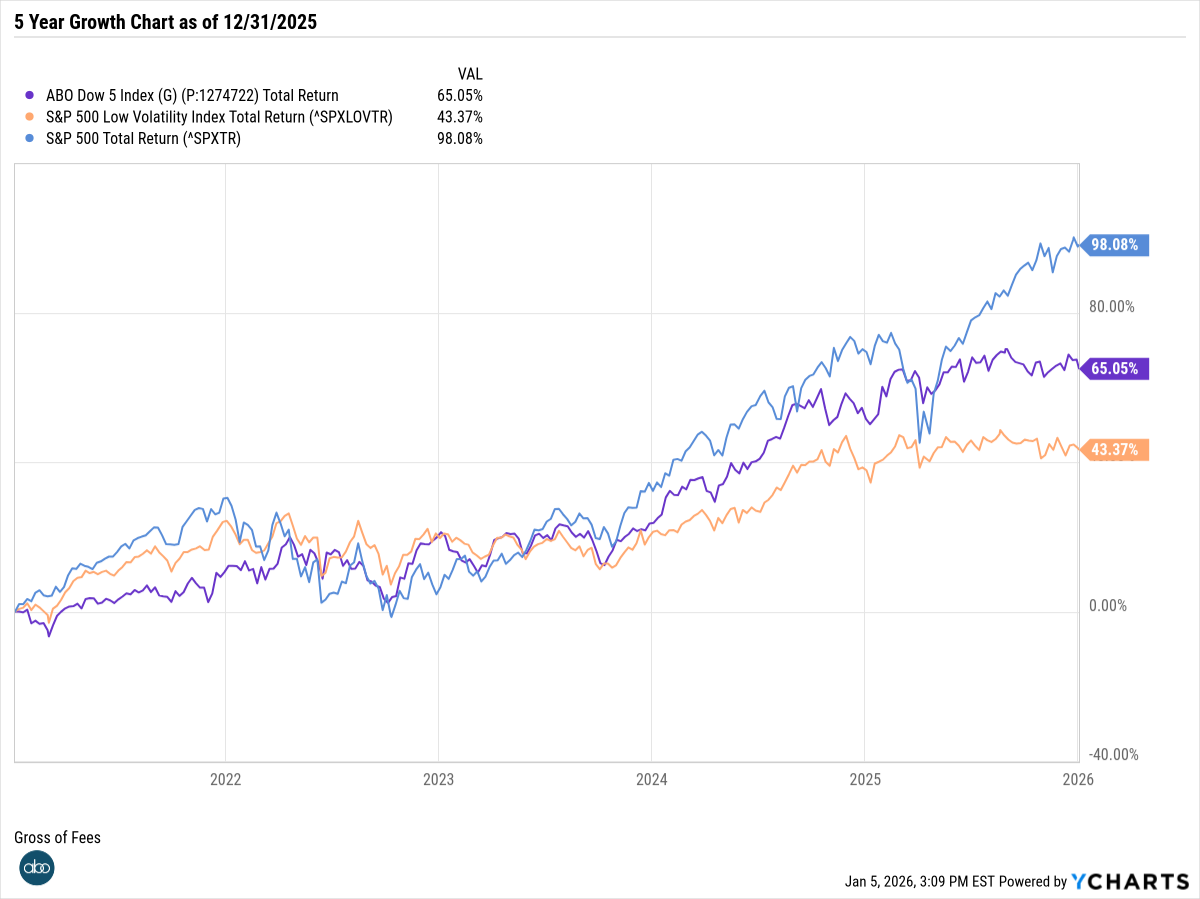

Equity Baskets: Low Volatility Value

Low-volatility equity baskets are mechanical strategies that systematically select stocks with lower historical price fluctuations to construct portfolios that outperform the market on a risk-adjusted basis while experiencing smoother returns and reduced drawdowns, defying traditional finance theory that equates higher risk with higher reward. The baskets hold 5 to 10 stocks.

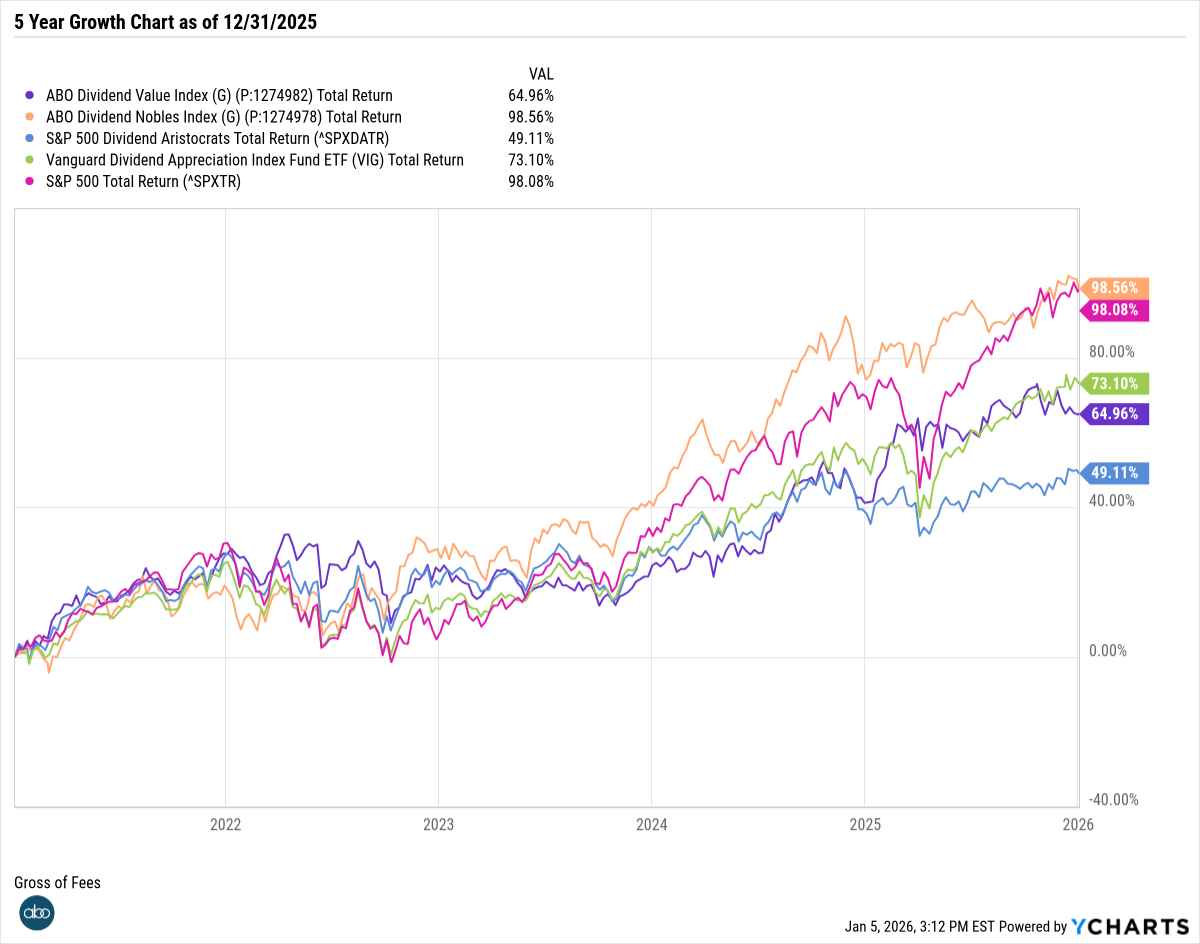

Equity Baskets: Dividend

Dividend equity baskets are mechanical strategies that systematically select and weight stocks based on dividend characteristics (yield, growth, payout ratio, consistency) to generate reliable income, lower volatility, and total returns with reduced risk, leveraging both cash flow stability and behavioral mispricing of income-focused securities. The baskets hold 10 stocks.

Tax-efficient equity baskets are mechanical strategies that systematically maximize after-tax returns by deferring gains, having ultra-low turnover, and holding periods beyond 1 year to ensure long-term capital gain treatment. These equity baskets hold 5 to 10 stocks.